At the beginning of 2020, B2B print publications received less advertising dollars than the previous year. COVID-19 only accelerated that trend.

Here, we dive into how the pandemic is affecting B2B print and the advertising trends shaping the shifts publishers face.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

COVID-19 forced B2B magazines to pivot quickly

In the midst of uncertainty, B2B publishers rapidly made decisions surrounding the distribution and financial viability of their print publications.

“It certainly took a huge toll on our industry and our revenue streams,” explained director of publishing at MPI and editor-in-chief of, The Meeting Professional, Rich Luna. “We decided to stop printing the magazine. Whether it’s temporary or not, we don’t know yet, but at least for the near future.”

The decision to quickly stop printing was largely made due to logistical reasons. Offices, where magazines are delivered, are closed and not receiving magazines.

The Meeting Professional already delivered a digital edition to its community. With COVID-19, community growth gained momentum rapidly. After the release of its May issue, page views, sessions, and unique visitors tripled compared to previous months. But increased traffic doesn’t necessarily equal more revenue. Publishers are faced with questions of how to make money when advertisers are spending less.

Brewbound—a leading B2B publisher for beer and other drink companies—said it needed to turn to a subscription model because beer lectures, conferences, and advertising made up a “significant portion” of its annual revenue. With events gone and advertisers pulling back, the publisher had to pivot their financial model.

BNP Media to the “difficult economic environment” for print publishers by accelerating pre-established plans. BNP Media planned on shifting about forty magazines to digital by the end of 2022, but that timeframe was condensed to three months. By August, nearly all of their magazine subscriptions are expected to be exclusively digital.

MediaRadar Insights

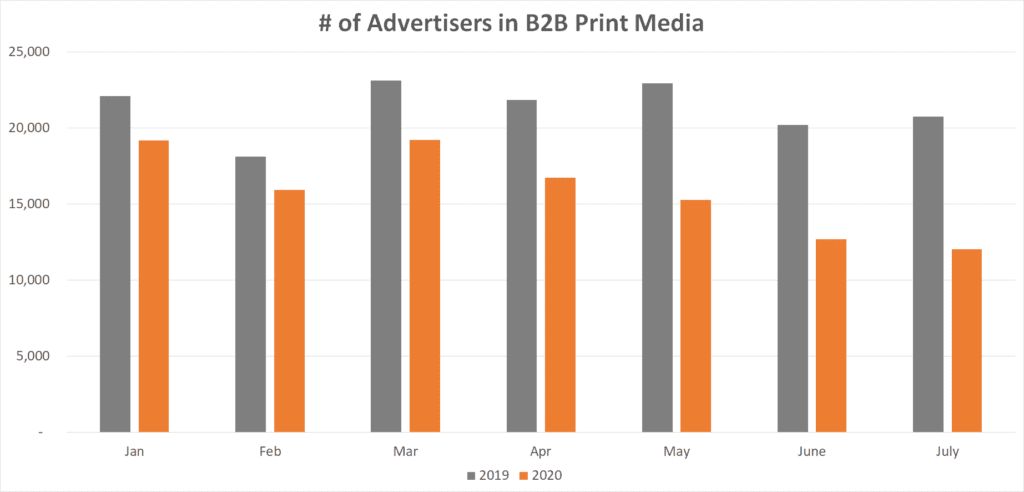

Due to pre-existing market trends, B2B print media was seeing a 13% decline in the number of advertisers in January and February (pre-COVID). However, amid the pandemic, conditions have become worse. By July, the number of advertisers buying B2B print media decreased by 42%.

It’s not simply because advertisers don’t want to buy print inventory. Part of this decrease is due to publishers cutting print frequency. From January to the beginning of August, these publishers have released roughly 10% fewer publications.

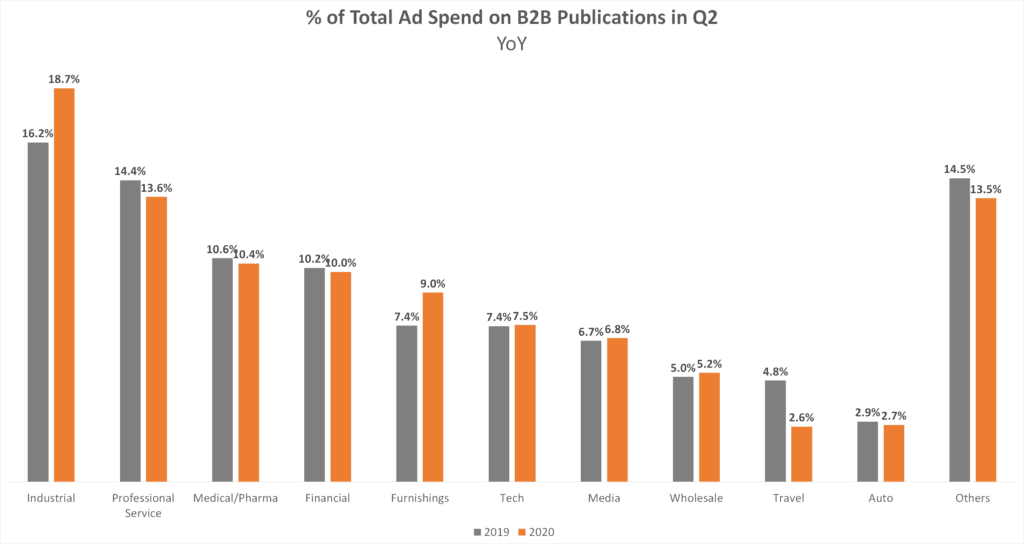

When it comes to particular product categories buying B2B print ads, industries have remained fairly consistent with their spending compared to last year. The few outliers that saw increased spending include Industrials and Furnishings. The Furnishings category includes at-home office equipment companies, which performed well with people transitioning to working-from-home.

Travel was another outlier—but instead saw a large drop in spending. Business travel was one of the first industries to be negatively impacted by the pandemic and is also experiencing a slower recovery.

As B2B magazines change their delivery and financial models, we will keep you informed on how advertisers respond.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.